Context

What is FGTS and how does it work?

The FGTS (Guarantee Fund for Length of Service) is a mandatory savings fund for all employees hired under the CLT (Consolidation of Labor Laws) in Brazil. Every month, a portion of the salary is deducted and deposited into this savings account.

How can one access FGTS funds?

There are two common ways:

- After dismissal for just cause: the person can access the total amount of FGTS;

- Opting for the Birthday Withdrawal: every year, in the birth month, the person receives a portion of the amount.

Since 2020, individuals can advance installments of the Birthday Withdrawal through financial institutions.

Challenge

Both Birthday Withdrawal and the Early Access to FGTS Birthday Withdrawal were unfamiliar services with unknown processes for many people. Additionally, ABC Brasil Bank had specific contracting conditions.

Solution

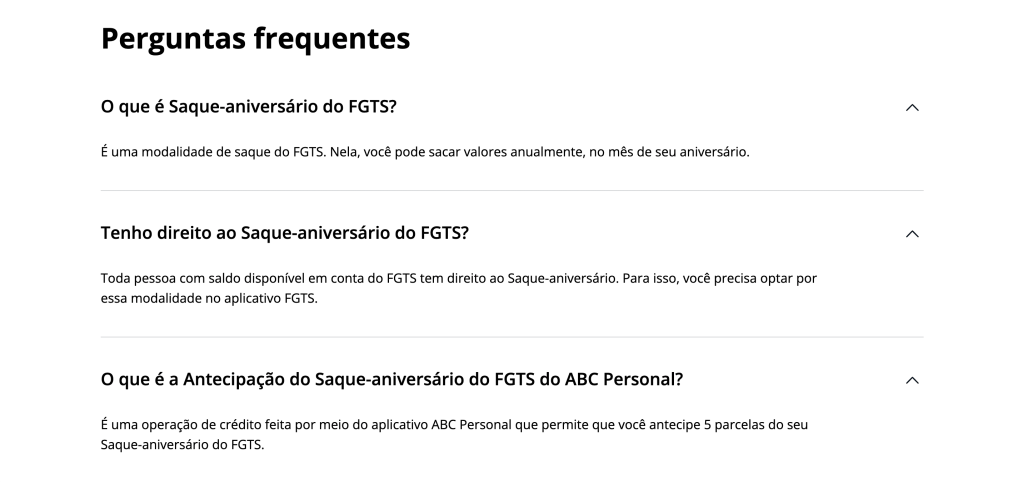

We created the FAQ to explain points such as:

- What is Birthday Withdrawal;

- Who was eligible;

- What is the Early Access to FGTS Birthday Withdrawal;

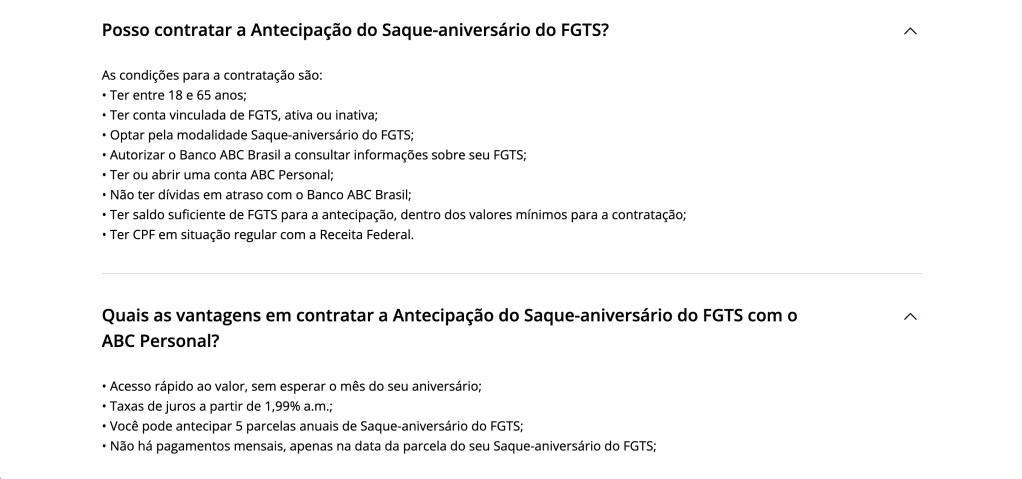

- Conditions for contracting;

- Advantages of contracting;

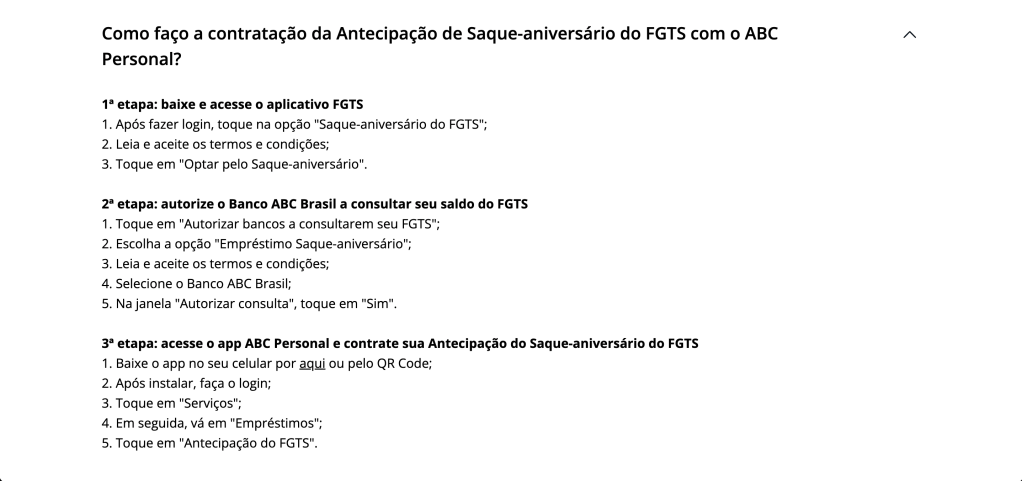

- How to contract;

- Specific conditions for contracting the advance with ABC Brasil Bank.

You can see the full FAQ here.

Benefits

- Autonomy: Reduction in the number of inquiries to clarify doubts;

- Easy understanding of the service: Use of plain language to simplify terms.